Following a recent shipment of 12,000 white feather broiler breeder chickens from France, Shandong Yisheng Livestock & Poultry Breeding Co Ltd in Yantai, Shandong province, has boosted its year-to-date imports to 174,000 sets, commanding a major share of China's total.

This volume solidifies the company's leading role in supplying the nation's white feather broiler breeding stock, said Lin Jie, president of the company.

It has maintained the leading position in China in terms of grandparent stock inventory.

The 14th Five-Year Plan period (2021-25) marked a half-decade of transformative growth for the company's breeding stock operations.

In addition to maintaining an annual supply capacity of over 20 million sets of parent stock chicks, the company has expanded its parent stock inventory, leading to a 40 percent increase in the annual output of commercial day-old chicks, from 470 million to 660 million.

This growth has supported the stable supply of white feather broiler breeding stock in China, Lin said.

Aligning with the national strategy of vitalizing the seed industry, Yisheng has achieved breakthroughs in the breeding of small-type white feather broilers.

The company's self-developed Yisheng 909 and Yisheng 817 hybrid strains have received official recognition as new national livestock and poultry breeds.

Lin said the latter is suitable for producing small-to-medium-sized products, while the former is geared toward medium-to-large-sized products. This differentiated portfolio allows the company the flexibility to meet market demand.

The market for small white feather broilers has emerged as the third-largest broiler segment in China, with annual live bird shipments reaching approximately 2.5 billion, Lin added.

"Given their cost advantages and meat quality, small white feather broilers hold vast market potential and promising prospects for future development," he said.

Guangzhou Baiyun International Airport in this Guangdong provincial capital has achieved remarkable results in promoting high-quality development during the 14th Five-Year Plan period (2021-25), laying a solid foundation for constructing a world-class aviation hub during the 15th Five-Year Plan period that begins in 2026.

Baiyun International Airport, one of the three aviation hubs in the country, has achieved a historic breakthrough in both the scale and capacity of its hub operations while serving the national strategies and the construction of the Guangdong-Hong Kong-Macao Greater Bay Area, said a statement released by Guangzhou Baiyun International Airport Company Ltd, a Shanghai Stock Exchange-listed company, over the weekend.

The airport, which became the world's busiest airport by passenger throughput in 2020, has maintained its position as China's top airport in terms of passenger throughput for four consecutive years.

And the airport handled 76.369 million passenger visits in 2024, reaching another historic high.

Meanwhile, the airport's transfer passengers hit more than 10 million for the first time, and cargo throughput surpassed 2.38 million metric tons, ranking among the global top 10, said the statement.

The airport has fully leveraged the 144/240-hour transit visa-free policy to attract passenger flow and deepen aviation-tourism collaboration with multiple countries and regions and airlines in the previous years, the statement said.

The airport, which now serves 251 destinations worldwide, has achieved full coverage of the 10 ASEAN countries while launching inaugural new passenger routes to Eastern Europe, Central Asia and South America in the previous five years, it said.

The airport, which has achieved an on-time flight performance rate of 91.6 percent, has implemented the country's first AMDB-based apron management system and become the first to shorten the international flight check-in deadline to 40 minutes, marking a quantum leap in operational efficiency.

Meanwhile, the airport has been ranked first globally in the ACI (Airport Council International) airport service quality survey for five consecutive years, while receiving the "ACI Asia-Pacific Cleanest Airport Award" for the second straight year, said the statement.

And the airport has also made its debut appearance on the GYBrand Top 20 World's Most Valuable Airports list, it said.

The airport successfully hosted the 2025 International Airport Expo, the 7th ACI Global Conference on Airport Experience, and the 10th China Airport Service Conference earlier this year, showcasing the aviation hub to the world.

Yunnan Baiyao Group Co Ltd, a household name in China's pharmaceutical sector, has, over the last five years, pursued diversification, innovation and financial stability, positioning itself among the most competitive players in the industry. Now, the company looks to continue to expand its presence in traditional Chinese medicine and the wider healthcare market.

Best known for its century-old TCM products, in 2024, Yunnan Baiyao's aerosol sprays, plasters, medicated bandages, toothpaste, and Panax notoginseng extracts maintained leading market shares in their respective categories. Notably, its flagship aerosol spray product achieved sales revenue exceeding 2.1 billion yuan ($294.78 million), marking a 26 percent year-on-year increase. Additionally, Yunnan Baiyao toothpaste has consistently led the Chinese market in terms of all-channel market share.

At the same time, the company has concentrated on its core business and deepening its roots in the pharmaceutical industry. It actively promotes the "TCM + Big Health" strategy under the 14th Five-Year Plan (2021-25), driving business development and performance growth.

Alongside its consumer-facing brands, the company has steadily invested in securing supply chain quality. It has built a full industrial chain for TCM resources, from planting to processing, as well as distribution to ensure safety and consistency.

The company has utilized technologies such as satellite imaging and AI-assisted procurement to monitor herb cultivation and improve sourcing. These measures, according to the company, are helping standardize upstream production and enhance the credibility of TCM in modern healthcare.

Operating research and development centers in Kunming, Beijing, Shanghai, Tianjin, and Wuxi — focusing on TCM research, drug development, and product upgrades — innovation is key to Yunnan Baiyao's business strategy.

Its innovation push also extends to manufacturing. In September, the World Economic Forum named Yunnan Baiyao's Smart Factory to the Global Lighthouse Network — the first facility in the TCM health products sector to receive the honor.

Despite a changing market environment, Yunnan Baiyao has maintained steady financial growth. Its operating revenue climbed from 32.7 billion yuan in 2020 to 40 billion yuan in 2024, with net profit attributable to shareholders also growing during this period.

Shareholders have benefited from the company's robust profitability. From 2022 to 2024, it distributed 10.7 billion yuan in cash dividends, with the payout ratio consistently above 90 percent — among the highest in the industry.

Internationally, Yunnan Baiyao is guided by the "dual circulation" development pattern. It leverages its subsidiary, Yunbai International, to strengthen its international platform in Hong Kong Special Administrative Region and develop an operational system that meets international standards. Additionally, it is accelerating its expansion into the ASEAN market, capitalizing on Yunnan's geographical advantages.

In February, Yunnan Baiyao achieved its first import clearance of TCM materials via the Mohan port, actively engaging in the international trade of TCM materials with Southeast Asian countries like Laos, thus contributing to the high-quality development of the TCM industry and regional economic growth. Four months later, the first batch of Yunnan Baiyao toothpaste produced in Thailand was successfully sold outside the Chinese mainland.

Analysts note that Yunnan Baiyao exemplifies how a traditional brand can adapt to modern market needs. By integrating TCM heritage with advanced R&D and a digitalized supply chain, the company has laid a foundation for sustainable growth.

Looking ahead, Yunnan Baiyao plans to achieve a new pattern of coordinated development in scale, structure, and quality.

"Yunnan Baiyao aims to become a leading domestic and world-class modern pharmaceutical industry group," Zhang Wenxue, Party secretary and chairman of Yunnan Baiyao, said. "We are committed to deepening our roots in the pharmaceutical industry, focusing on our strengths in the health sector, and strategically and prudently advancing new business growth points. Through these efforts, we hope to contribute to the long-term development of China's healthcare industry."

KPC Pharmaceuticals Inc, a leading drug maker headquartered in Yunnan province, has accelerated its research and development endeavors to diversify its product offerings and strengthen its global presence, with a particular focus on botanical medicines.

Leveraging the province's trove of medicinal plants, KPC is sharpening its focus on treatments for chronic diseases and healthy aging. Central to this strategy is its proprietary "777" brand, focused on the Panax notoginseng series, one of more than 40 natural botanical drugs the company has developed.

"By focusing on the '777' brand, we aim to strengthen our position in chronic disease management and deliver effective solutions to patients globally," Yan Wei, KPC president, said.

"Our commitment to innovation and research remains unwavering as we continue to explore new frontiers in natural medicine."

Founded in 1951, KPC boasts a long history of pharmaceutical innovation. The company was listed on the Shanghai Stock Exchange in 2000, a milestone that marked the beginning of its expansion into international markets. Today, KPC operates more than 50 subsidiaries and sells products in over 60 countries.

The company has been recognized as a national high-tech enterprise and a leader in intellectual property, with notable achievements including the advancement of artemisinin, a groundbreaking anti-malarial treatment.

Currently, KPC is in what it calls a strategic phase of high-quality development and innovation. Beyond strengthening its Chinese medicine portfolio highlighted by the "Kunming TCM 1381" brand, which holds a Guinness World Record as the world's oldest continuously operating pharmaceutical business, the company is targeting the rapidly growing "silver age" health industry.

Its research pipeline is designed to address core areas of elderly health and chronic disease, including cardiovascular and musculoskeletal. In 2025, KPC reported progress in several innovative drug programs. Among them, a natural medicine for ischemic stroke, which is advancing in Phase II clinical trials.

KPC is also stepping up its global push with artemisinin products, particularly in Africa, where it has become a leading brand in malaria treatment. The company manages the entire value chain from seed cultivation to international distribution, bolstering its competitiveness in overseas markets.

Inner Mongolia Dian Tou Energy Corporation Limited, also known as IMDTECL, has successfully transitioned from a traditional energy enterprise to a clean energy provider in just a few years' time.

The company saw its renewable energy capacity reach around 5 million kilowatts in 2024, accounting for over 62 percent of its total installed capacity, Zhao Changyu, head of the company's new energy department, said.

IMDTECL, the sole listed financing platform of State Power Investment Corporation (SPIC) in the Inner Mongolia autonomous region, has strategically shifted its focus towards green energy during China's 14th Five-Year Plan period (2021-2025), aligning with the nation's energy security and dual carbon goals.

The company has built a diversified energy industry system with coal, thermal power, new energy, and electrolytic aluminum as its business cornerstones. It boasts an annual coal production capacity of 48 million tons, 3 million kilowatts of thermal power capacity, around five million kilowatts of new energy capacity, and 860,000 tons of electrolytic aluminum capacity.

Additionally, IMDTECL has built a "coal-new energy-electricity-aluminum" circular economy model, utilizing low-quality coal for power generation and green electricity for electrolytic aluminum production.

Cementing its commitment to clean energy, IMDTECL has invested in manufacturing and technology innovation to promote clean, green, low-carbon, and intelligent operations across its industrial chain.

Shifts in IMDTECL's production processes — such as using unmanned mining trucks and automation systems in its electrolytic aluminum production —have reduced emissions and improved efficiency.

The changes position the company favorably in a market increasingly focused on sustainability, Lin Boqiang, head of the China Institute for Studies in Energy Policy at Xiamen University, said.

The trend of unmanned mining trucks and automation systems is transforming the mining industry, driving greater efficiency, safety, and sustainability, he said.

IMDTECL has been optimizing its industrial structure and embracing low-carbon initiatives in recent years. As a result, its assets have grown from 34.5 billion yuan ($4.83 billion) to 55 billion yuan, with owner's equity increasing from 20.6 billion yuan to 40 billion yuan.

The company's profitability has also seen steady growth, with total profits rising from 5.6 billion yuan in 2021 to 6.9 billion yuan in 2024. Net profit attributable to shareholders also increased jumping from 3.6 billion yuan to 5.3 billion yuan.

"This investment is expected to enhance long-term competitiveness and profitability. As technology continues to advance, we can expect to see even wider adoption of these technologies in the years to come," Lin said.

During the 14th Five-Year Plan (2021-25) period, integrated circuit company Shanghai Belling Corp Ltd became the world's largest provider for electric energy metering chips in comprehensive gauges. The company now accounts for 70 percent of the production of single-phase metering chips, while its global market share for three-phase metering chips rose from 10 to 30 percent.

Shanghai Belling has enjoyed many milestones over the last five years. From gaining the largest market share in China regarding high precision analog-to-digital converters (ADCs), to being one of the first companies to realize domestic substitution in terms of the reliable application of high-speed ADCs.

Its annual sales of power management chips has exceeded 5 billion units, ranking among the top three regarding domestic shipments, and their new power devices, such as IGBT and MOSFET products, have seen their sales spike by 400 percent from 2021 to 2025.

All these achievements can be largely attributed to the company's increased efforts in technology innovation.

In 2024, Shanghai Belling's research investment surged 20 percent year-on-year to 430 million yuan ($60.4 million). The company has devoted over 1.7 billion yuan of research investment during the 14th Five-Year Plan (2021-25) period, with the compound average growth rate coming in at 34 percent.

Shanghai Belling's dedication to research has yielded positive results. In the last five years, the company has managed to build a comprehensive product layout for power and analog ICs. By mid-2025, the number of products the company offers had reached 4,559.

Shanghai Belling has also consolidated its leading position in industries where it has more of a competitive edge. For example, its market share in the power industry has risen from 20 to over 30 percent.

During the 14th Five-Year Plan (2021-25) period, Shanghai Belling has also accelerated upgrades for product application the automotive electronics, high-end industrial control, and new energy industries, developing a high-performance, highly reliable power chain and signal chain IC products.

Breakthroughs have also been made in strategic emerging industries like automotive electronics. Over 80 of Shanghai Belling's products have been installed in various vehicle models so far.

The company's strong fiscal results show that the efforts have paid off.

Despite the headwinds and uncertainties in the global IC market, Shanghai Belling's consolidated revenue is expected to exceed 3 billion yuan by the end of 2025, with consolidated revenue from IC sector estimated at about 2.2 billion yuan. By the end of 2020, the company saw its consolidated revenue coming in at 1.332 billion yuan, while its IC design generated about 971 million yuan. The compound annual growth rate of consolidated revenue is expected to grow over 18 percent in the next five years.

The company's market cap has also jumped from less than 10 billion yuan to a peak of over 37 billion yuan.

Shanghai Belling not only focuses on its own business growth, but is also devoted to facilitating the development of the whole ecosystem. In the last five years, it has nurtured a number of technologically advanced small and medium-sized enterprises, including Shenzhen Renergy Technology Co Ltd, Nanjing Micro One Electronics Inc, and Shenzhen-based Sytatek.

Experts work at the research and development center of Shanghai Belling Corp Ltd on Sept 15.

shijing@chinadaily.com.cn

Donkey-hide gelatin maker Dongeejiao Corp Ltd is employing new technology and a new resources allocation mode to advance its plans for high-quality development.

As a result of a thorough reform process, the company's business performance has witnessed steady growth. Data from the company showed that, between 2020 and 2024, the compound annual growth rate of sales revenue reached 14.88 percent, while that of net profit reached 100.4 percent.

In 2023, Dongeejiao, which is based in Liaocheng, Shandong province, launched a "one-two-three-eight" strategy to guide the company's development during the 14th and 15th Five-Year Plan periods.

The number "one" refers to "one positioning" as the company seeks to position itself as "the most trusted leader in nourishing products by the public".

Two refers to "double-wheel driven". The two wheels are medicines and healthcare consumer products. Based on the connotation of nourishing health, the company aims to meet people's needs for physical and mental health management throughout their entire life cycle. The two wheels promote and empower each other, driving the growth of business connotation and achieving high-quality development of the company.

Three refers to "the merging of three industries". The first industry focuses on breeding and resource supply guarantee, and ensures the sustainability of donkey-hide raw materials. The second industry focuses on the development of the main industry, creating a top stream nourishing health brand represented by Dongeejiao, and integrates online and offline resources to form full-link communication. The third industry is cultural guidance, by taking advantage of culture inheritance to tell the story of Chinese medicinal culture with nourishing national treasures, expanding new business models and new formats, and creating a "sample of Chinese medicine culture" with Dongeejiao characteristics.

Eight refers to "eight capabilities", which are industrial chain construction, brand building, omni-channel marketing, intelligent digital transformation, agile supply, research and development innovation, capital operation, and organizational support. These eight capabilities ensure the company's high-quality development.

"In the future, Dongeejiao will stick to high-quality development, taking advantage of new quality productive forces, and continuously enhance the company's core competitiveness," said a company spokesperson.

"Furthermore, we will firmly shoulder the mission of playing a leading role in the inheritance and innovation of traditional Chinese medicine culture, be the most trusted leader in nourishing products by the public, and make greater contributions to the development of the national traditional Chinese medicine industry."

zhengyiran@chinadaily.com.cn

Focused on both endogenous growth and external expansion, Shenzhen Stock Exchange-listed Pacific Shuanglin Bio-pharmacy Co Ltd has achieved high-quality development during the 14th Five-Year Plan period (2021-25).

As a blood product maker, at the beginning of the 14th Five-Year Plan period, Pacific Shuanglin was in the second tier. It was then that the company formulated a "three-step" strategic development plan.

In the near future, it intends to achieve endogenous growth through a focus on internal tapping. In the mid-term, endogenous growth and outward expansion will be pursued simultaneously, with the promotion of mergers and acquisitions and integration to accelerate the company's expansion and development. In the long run, the company will seek to learn from the development direction of overseas blood product giants, follow international first-class standards, deepen its understanding of traditional blood products, actively explore non-blood related businesses, and strive to become a leading biotechnology enterprise.

In terms of endogenous growth, due to multiple equity changes, Pacific Shuanglin's business development was relatively slow before the 14th Five-Year Plan period. The company achieved rapid growth in business performance in 2019 and 2020 by improving its corporate governance structure, enhancing decision-making and operational efficiency, strengthening refined management, reducing operating costs, addressing legacy issues, establishing long-term incentive mechanisms, and introducing modern management systems.

During the COVID-19 pandemic, the intravenous immunoglobulin (pH4) produced by the company was included in the treatment plan by several medical institutions and included in the list of drugs reserved by China's Ministry of Industry and Information Technology because of its ability to enhance the anti-infection ability of the body and improve immunity. This drew attention from the blood product industry.

However, raw plasma has become a bottleneck restricting product supply and the development of blood product enterprises. In order to rapidly increase the scale of raw plasma, the company actively promotes outward expansion and completes strategic restructuring work and cooperation with Xinjiang Deyuan Biological Engineering Co Ltd.

Through endogenous growth and external expansion, Pacific Shuanglin realized rapid development during the 14th Five-Year Plan period. In 2024, the company's sales revenue reached nearly 2.7 billion yuan ($379.1 million), and net profit reached 745 million yuan.

Between 2020 and 2024, compound annual growth rate of the company's sales revenue was 26.1 percent, while that of net profit reached 42.11 percent.

Editor's note: The China Association for Public Companies, together with China Daily and other media outlets, has launched the initiative Listed Companies in Action: My Five Years in the 14th Five-Year Plan. The campaign spotlights the achievements of Chinese listed companies in advancing high-quality development during the 14th Five-Year Plan period.

China CYTS Tours Holding Co Ltd, a Beijing-based tourism service provider, said it will further expand the research and development of inbound tourism products to welcome more international visitors and enhance their travel experiences in China.

As China continues to boost inbound tourism and extend unilateral visa-free policies to more countries, CYTS said it will fully leverage its resources, such as its multilingual websites, and continue to train more professional tour guides.

"Catering to the demand of a growing number of individual business and leisure inbound visitors, CYTS has launched inbound tourism websites in English and Japanese, providing foreign visitors with personalized and customized tourism products and services in China," Ni Yangping, president of CYTS, said.

Founded in 1980, CYTS is among China's earliest travel agencies qualified to receive overseas tourists. It has witnessed the reform and opening-up of the country's tourism industry and pioneered innovative business models in the sector.

In 1997, the firm became the first domestic travel agency with a comprehensive tourism business agenda to list on the A-share market in Shanghai. Now, its business footprint spans major cities at home and abroad, serving more than 68 million tourists annually.

During the 14th Five-Year Plan period (2021-25), the company has centered its efforts on meeting consumer demands while continuously innovating its business formats.

For instance, the ancient town of Wuzhen scenic area in Zhejiang province, owned by CYTS, has hosted a variety of events, most notably the annual World Internet Conference. The company has also developed Beijing Wtown, a water town resort located at the foot of the Simatai section of the Great Wall.

This expansion of business formats has transformed CYTS from an enterprise focused primarily on travel agency services, into a comprehensive tourism service provider. Its current business portfolio covers cultural and tourism operations, scenic spot management, integrated marketing, and hotel management.

Chinese NEV giant BYD is accelerating high-quality growth on the back of sustained R&D investment during the 14th Five-Year Plan (2021-25) period, having expanded its industrial scale and advanced overseas.

BYD's new energy vehicle sales have risen rapidly in recent years. While the company's one-millionth NEV rolled off the line in 2021, by 2023, that figure had climbed to five million. Cumulative NEV sales have now surpassed 13.4 million units, with the company saying that BYD continues to lead the global NEV market.

The growth momentum has continued in 2025. From January to August, BYD sold 2,863,876 vehicles worldwide, including 630,728 units in overseas markets. In August alone, total sales reached 373,626 units, while overseas sales of passenger cars and pickups came in at 80,464 units, up 146.4 percent year-on-year, making overseas markets a key growth driver.

BYD attributes the rapid sales growth to sustained investment in research and development. The company said its cumulative R&D spending has exceeded 210 billion yuan ($29.44 billion).

In the first half of 2025, BYD unveiled a slate of technologies – most notably the "God's Eye" advanced driver-assistance system (ADAS), the Super e-Platform with Megawatt Flash Charging, and the Lingyuan intelligent vehicle-mounted drone system — which it says are helping to drive industry-wide innovation.

According to BYD, God's Eye now supports map-free city navigation on autopilot nationwide. Since the company's smart-technology strategy event in February, around 1.2 million vehicles equipped with the system have been sold, placing BYD among the leaders in China by sales of models equipped for intelligent driving and making God's Eye one of the most widely installed ADAS suites in the market.

BYD claims the Super e-Platform with Megawatt Flash Charging delivers the highest peak charging power among mass-produced models, with a 1,000-kilowatt architecture, and can add about 400 kilometers of range in just five minutes.

BYD's technology leadership is also reflected in intellectual property. According to rankings released by China Auto Information Technology (Tianjin) recently, BYD placed first in China for granted patents across three categories – NEV technologies, hybrid technologies and pure electric technologies.

Overseas expansion has also gathered pace. In 2024, BYD's passenger vehicle overseas sales reached 417,200 units, up 72 percent year-on-year. In the first half of 2025, BYD said it ranked No 1 by NEV sales in several markets, including Italy, Turkiye, Spain and Brazil.

To support global logistics, the company operates seven Ro-Ro (roll-on/roll-off) car carriers, and its NEV products have entered more than 116 countries and regions to date.

Achieving steady growth in scale and competitiveness, Guangzhou, Guangdong province-based Tinci Materials Technology Co has made significant strides during China's 14th Five-Year Plan period (2021-25).

Riding the rapid expansion of the new energy industry chain, the company said it had seen its revenue grow at the fastest pace since its founding during the five-year period. With a strategy centered on "integration plus globalization", it has expanded upstream integration in electrolytes and extended into cathode materials, resource recycling, and specialty chemicals.

Innovation served as another cornerstone. Over the 14th Five-Year Plan period, the company invested 3.02 billion yuan in R&D, lifting the share of R&D expenditure to revenue from 3.41 percent in 2021 to 6.24 percent in the first half of 2025.

At the same time, Tinci has stepped up its overseas intellectual property management. By the end of June 2025, the company had filed 1,141 patent applications, with 587 granted worldwide.

Strong internal governance and controls also underpinned its progress. The company issued and revised more than 40 corporate governance documents during the period, while the audit and supervision department carried out proactive inspections and real-time oversight of critical projects and tenders. According to the company, no major non-financial internal control deficiencies were reported between 2021 and 2024.

Adopting a combined approach of cash dividends and share buybacks, the company has also placed strong emphasis on delivering reasonable returns to investors. It has distributed 2.696 billion yuan in cash dividends over the past three years — equal to 85.61 percent of its average net profit — while also completing three share repurchase programs worth more than 600 million yuan, data provided by Tinci showed.

Looking ahead, the company said it will continue to sharpen its innovation-driven edge, strengthen global expansion, and build a long-term, sustainable value-creation mechanisms for shareholders, while contributing to the green transformation of the global new energy industry.

lijiaying@chinadaily.com.cn

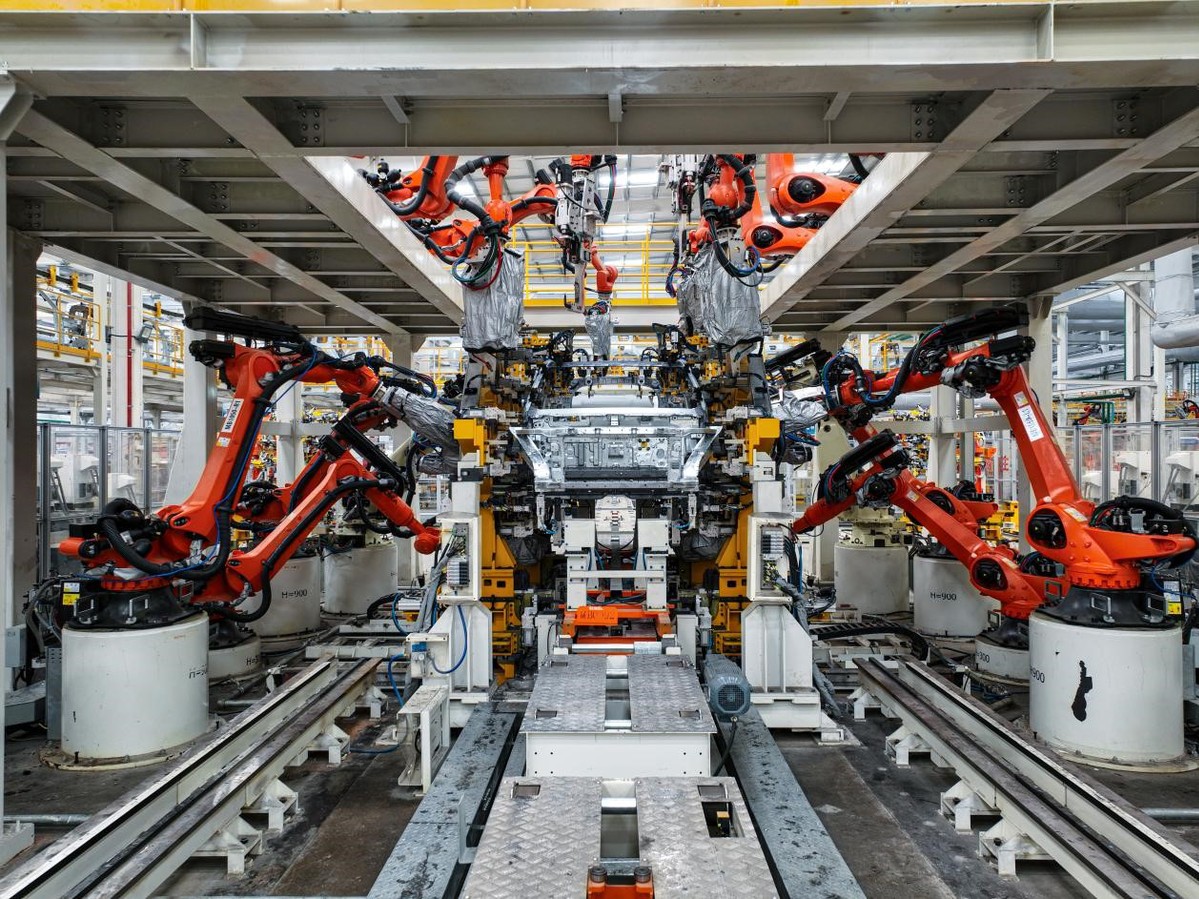

Great Wall Motor has ramped up efforts in high-quality manufacturing and core technology R&D during the 14th Five-Year Plan period (2021-25), with patent and sales figures showing steady growth.

As of June 2025, GWM had filed nearly 50,000 patent applications, and secured close to 30,000 grants. From January to August 2025, the automaker sold 789,719 vehicles, up 5.94 percent year-on-year.

In August alone, new energy vehicle sales reached 37,495 units, a year-on-year rise of 50.92 percent, while overseas sales for the month increased 11.65 percent to 45,166 units.

GWM's annual R&D spending has topped 10 billion yuan ($1.4 billion) for three consecutive years.

The company now boasts an R&D team of about 23,000 people and has developed a comprehensive testing system that includes the first safety laboratory by a Chinese automaker, the first comprehensive proving ground among domestic carmakers, and the country's first high-altitude environment simulation lab and climatic wind tunnel lab.

In addition, it has set up the industry's first interactive experience laboratory integrating VR, HMI, full-vehicle simulation and human-factors testing.

In 2024, GWM commissioned a multi-angle crash laboratory, which is said to be Asia's largest independent safety lab.

In the intelligent NEV segment, GWM has developed the Hi4 technology system, integrating high-efficiency engines, transmissions and electric-drive components tailoring solutions for different scenarios.

In the off-road segment, GWM is the first in the industry to apply power-split technology to off-road models, offering gasoline, diesel, hybrid and plug-in hybrid powertrains.

According to the company, vehicles based on this system deliver up to 715 kilowatts of output and accelerate from 0 to 100 kilometers per hour in four seconds.

Among plug-in hybrid off-road models, the electric-only range exceeds 200 km. GWM said it remains the sales leader in China's off-road market and has made technical advancements across city SUVs, MPVs and heavy-duty trucks.

GWM's global footprint continues to expand rapidly. Its overseas sales network now includes more than 1,400 outlets, with a global user base exceeding 15 million.

The company has sold over 2 million units internationally, with models entering markets in Dubai, Australia and South Africa.

The automaker operates three full-vehicle manufacturing factories abroad, including one in Thailand, and runs knock-down plants in countries such as Ecuador.

Its factory in Brazil is scheduled for completion in the second half of 2025, further supporting its ambition to serve as a global calling card for China's auto industry.

SUMEC Group Corporation (SUMEC), a subsidiary of China National Machinery Industry Corporation, will accelerate its expansion in strategic emerging industries and strengthen its overseas presence during the upcoming 15th Five-Year Plan (2026-30) period, its top executive said.

Supported by more than 16,000 employees, SUMEC, headquartered in Nanjing, Jiangsu province, operates 28 plants worldwide. Its business portfolio spans supply chain operations, consumer goods manufacturing, strategic emerging industries, shipbuilding, ecological protection and clean energy, all developed during the 14th Five-Year Plan(2021-25)period.

"After years of development, we have established a solid presence in sectors such as environmental engineering, new energy, high-efficiency power generation equipment and power tools, intelligent robotics, green vessels and biodegradable plastics, continuously opening new tracks and reinforcing growth momentum," said Yang Yongqing, board chairman of the company.

For example, SUMEC has undertaken more than 300 water treatment engineering projects across China, with a combined daily processing capacity exceeding 30 million metric tons, contributing actively to pollution control, water quality protection and ecological balance.

The company has also built photovoltaic power stations with a combined capacity of nearly 3 gigawatts across 18 provinces, municipalities and autonomous regions in China, as well as in multiple economies participating in the Belt and Road Initiative.

In the first half of 2025, SUMEC recorded $1.88 billion in foreign trade with countries and regions involved in the BRI, marking a 20.8 percent year-on-year increase.

Yang stressed that SUMEC will intensify efforts to expand in emerging markets, with a focus on Southeast Asia, the Middle East, Central Asia, Africa and South America to capture new business opportunities.

The company has been prioritizing emerging markets, aligning with the core needs of Chinese companies expanding globally by offering one-stop, customized and end-to-end integrated service solutions.

SUMEC has already launched multiple "going global" projects in countries such as Uzbekistan, Malaysia and Thailand. Its electromechanical equipment exports reached $320 million in 2024, jumping 87 percent year-on-year.

In the first half of 2025, the company posted 55.1 billion yuan ($7.74 billion) in operating revenue and $6.14 billion in foreign trade.

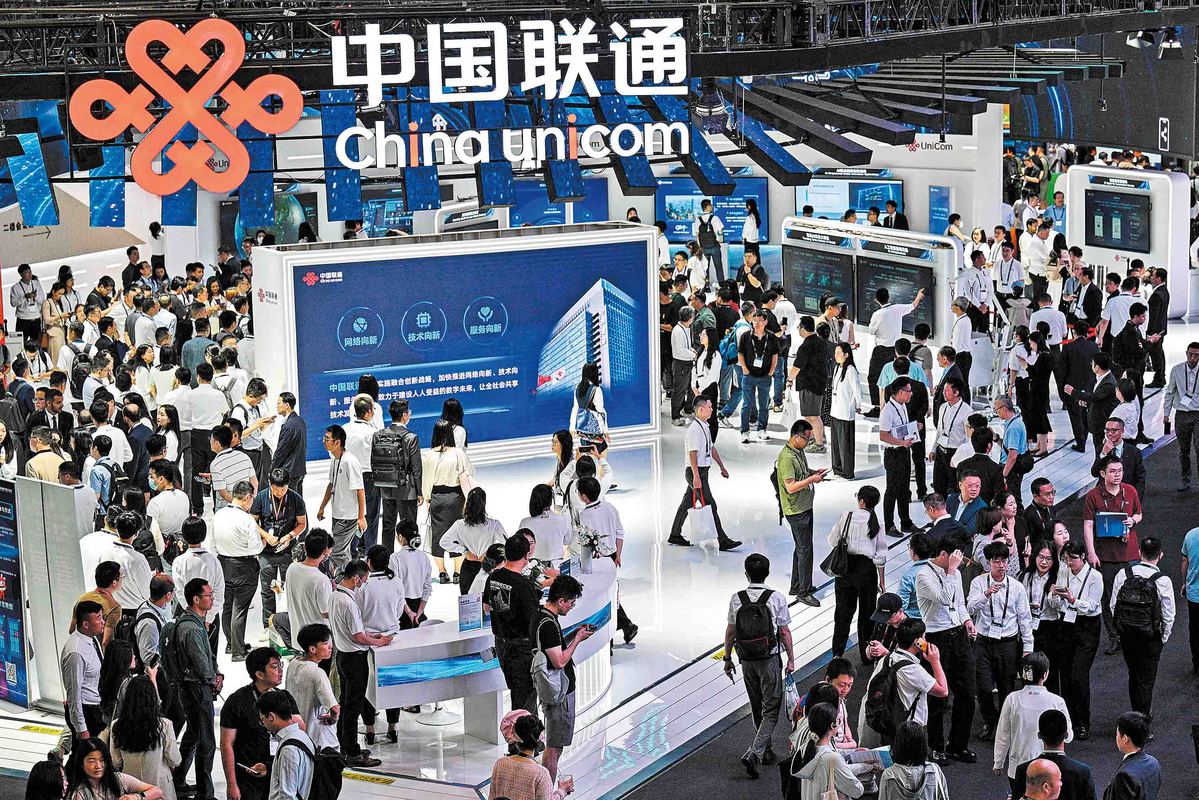

China Unicom is advancing the deep integration of digital intelligence technologies into real-world scenarios, accelerating the widespread adoption of artificial intelligence to benefit industries and society.

Chen Zhongyue, chairman of China Unicom, emphasized the strategic importance of AI agents in commercial value realization, highlighting that "AI agents are key to unlocking commercial value".

For enterprise customers, China Unicom has built a cutting-edge big data platform and developed high-quality data sets. The company has created more than 40 industry-specific large models and launched the "Gewu" industrial internet platform. This effort has resulted in the implementation of 30,000 industrial internet projects and the development of 7,500 5G-connected factories.

Furthermore, China Unicom has supported 6.5 million small and medium-sized enterprises in their transition to cloud computing, data utilization, and AI empowerment.

For individual and household customers, China Unicom has upgraded its Smart Family platform, introducing a suite of cloud-based and AI-powered products. The company is also expanding applications such as AI-powered medical consultations, smart home devices, and intelligent security solutions. A key initiative is the promotion of "Zhijia Tongtong", a family robot designed and developed independently by China Unicom, bringing advanced AI assistance into households across the country.

Through these efforts, China Unicom is steadfastly fulfilling its mission to harness AI for the benefit of all sectors of industry and every household, driving digital transformation and intelligent advancement nationwide.

Aeolus Tyre Co Ltd, a subsidiary of the State-owned Sinochem Holdings Corp Ltd, will ramp up production of premium truck and bus tires as well as seeking innovations in off-the-road and specialty tires over the next five years, according to its top executive.

The Jiaozuo, Henan province-based company is moving to capture opportunities across both traditional and emerging sectors as demand for advanced, durable and energy-efficient products continues to rise.

Wang Jianjun, chair of the board at Aeolus, said the company's latest offerings — including snow tires, dedicated tires for electric buses and ultra-low rolling resistance products — are tailored for heavy-duty transport and new energy scenarios.

Since giant tires have become a strategic priority for Aeolus, the company broke ground in May on a 20,000-unit capacity factory in Jiaozuo.

The project is expected to raise annual output to 30,000 units by 2026, with trial runs and full production scheduled to begin in August next year. By enhancing product performance, service and overall competitiveness, the company aims to lift its global market share to 8 percent.

"We will diversify our portfolio in ports, underground operations and agriculture to enhance product quality, cut costs and strengthen competitiveness in both home and emerging markets," said Wang.

Having made steady progress during the 14th Five-Year Plan period (2021-25),the company still has considerable room to grow its overseas revenue, Wang said. Aeolus will optimize its global footprint by strengthening subsidiaries in Chile, Indonesia, South Africa and Australia, further expanding coverage across the world, he said.

"We will continue to capitalize on the market opportunities brought by the Belt and Road Initiative, actively expanding sales channels in participating countries and advancing its international footprint through multidimensional strategies," he added.

That sentiment is in line with the latest foreign trade data. China's trade with economies participating in the BRI increased 5.4 percent year-on-year to 15.3 trillion yuan ($2.15 trillion) in the first eight months of 2025, data from the General Administration of Customs showed.

China Unicom is advancing the development of key digital infrastructure, including international submarine cables and Haikou International Information Port, to support Hainan Free Trade Port in nurturing new quality productive forces and strengthening its global digital connectivity.

Gan Quan, deputy general manager of China Unicom's Hainan provincial branch, told China Daily that a major milestone was reached in May as the main structure of China Unicom's Hainan Lingshui international submarine cable landing station was completed after 80 days of construction.

Located in Li'an town, Lingshui Li autonomous county, the station will serve as a critical hub for two major international submarine cable systems — SEA-H2X and ALC — connecting Hainan with the Hong Kong Special Administrative Region, Singapore, Thailand, Malaysia, the Philippines and other regions, Gan said.

"The integration of these submarine cables is set to significantly reduce network latency between Hainan and Southeast Asia by approximately 9 milliseconds. This millisecond-level ultra-low latency will provide a strong boost to industries such as international trade, finance, technological innovation, e-commerce and cross-border data flow, enhancing Hainan's competitiveness in the global digital economy," he said.

Moving forward, China Unicom's Hainan provincial branch will accelerate the subsequent phases of the submarine cable landing station, along with the construction of the China Unicom Haikou International Information Port and the Haikou international communication services entrance bureau. These initiatives will leverage China Unicom's international cable network to elevate the province's strategic position in global communications infrastructure, Gan said.

The executive highlighted that by aligning with local industrial policies and promoting technological integration, China Unicom is contributing its expertise and resources to help develop new quality productive forces in Hainan Free Trade Port.

The Haikou International Information Port project is currently in full swing and is scheduled for completion on Sept 30. As a key initiative under China Unicom's strategy to support Hainan's digital transformation, the port will incorporate an international communications services entrance bureau, a next-generation intelligent computing data center, and international submarine and terrestrial cable connectivity into a single, green, high-tier computing campus.

It will provide enterprises with a secure and scalable international data and computing platform, supporting network-computing integration in sectors such as finance, healthcare, education, aerospace, seed industry and deep-sea exploration, while fostering the growth of emerging industries, the company added.

The move is part of broader efforts by Hainan to fully develop its digital infrastructure to better support the development of emerging industries.

Huang Yejing, deputy head of the Hainan provincial department of industry and information technology, said the province is making progress in digital infrastructure.

In 2024, China's telecom operators received approval to establish full-service international communication entrance bureaus in Haikou — the first such expansion in China in 30 years. Additionally, two new submarine cables linking Hong Kong and Southeast Asia are under construction, further enhancing Hainan's international communications capabilities, Huang said.

He said Hainan Free Trade Port has pioneered innovations in secure and orderly cross-border data flow. The overseas initiative to expand e-gaming development continues apace, forming industrial clusters.

These developments reflect Hainan's commitment to embracing global interconnection and openness in the digital economy era, promoting high-quality development through high-standard openness and establishing itself as an international communications hub.

In February, the Ministry of Industry and Information Technology granted the first batch of value-added telecom business pilot approvals to 13 foreign-funded enterprises in Hainan and three other regions, two of which are based in Hainan. This marks a critical step in Hainan Free Trade Port's efforts to expand digital sector openness and explore new pathways for institutional innovation.

Domestic pharmaceutical company China Resources Sanjiu reported solid gains during the 14th Five-Year Plan period (2021–25), driven by innovation, green development, and global vision.

The Shenzhen, Guangdong province-based company achieved steady growth in scale and profitability, with a compound annual growth rate of about 23.6 percent in revenue and 24.5 percent in total profit over the past three years, according to the company.

At the same time, CR Sanjiu continued to deliver robust returns to its shareholders. Since its listing, the firm has raised 1.67 billion yuan ($234.1 million) through stock issuance while distributing around 9.32 billion yuan in dividends — more than five times its actual fundraising.

Innovation has played a central role in its growth trajectory. The company's research and development investment rose from 581 million yuan in 2020 to 953 million yuan in 2024, marking a 64 percent increase. As of the first half of 2025, it had 205 research projects underway, covering key therapeutic areas such as cardiovascular and metabolic diseases, oncology, respiratory illnesses, neurology and psychiatry, gastroenterology, and dermatology, the company said.

In advancing sustainability goals, it has also embedded the dual carbon goals into its business operations. In 2025, its MSCI ESG rating was raised by two notches to A, underscored by strengthened green transition and sustainability capabilities.

As a major player in strengthening the traditional Chinese medicine sector, the company has actively pursued strategic acquisitions. In January 2023, it acquired a 28 percent stake in Kunming, Yunnan province-based KPC Pharmaceuticals, completing the first A-share acquisition of its kind to qualify as a major asset restructuring.

In March 2025, it followed with another landmark deal, acquiring a 28 percent stake in Tianjin-based Tasly, marking the second such transaction during the 14th Five-Year Plan.

The three enterprises now form a complementary structure to build differentiated competitiveness through deepened collaboration. CR Sanjiu positions itself with consumer healthcare at the core to become an industry leader, while Tasly focuses on prescription drugs, and KPC Pharmaceuticals leverages its flagship TCM products to target the silver economy.

Looking ahead, as the company prepares to conclude the 14th Five-Year Plan and map out the 15th, CR Sanjiu said it will continue to shoulder its responsibility as a centrally administered State-owned enterprise, sharpen its core business focus, and accelerate innovation-driven transformation. By doing so, the drugmaker aims to offer "Chinese wisdom" and "Chinese solutions" for human well-being, it said.

lijiaying@chinadaily.com.cn

Editor's note: The China Association for Public Companies, together with China Daily and other media outlets, has launched the initiative Listed Companies in Action: My Five Years in the 14th Five-Year Plan (2021-25), highlighting the achievements of Chinese listed companies in advancing high-quality development.

Heng Lin Home Furnishings Co Ltd, a furniture and home furnishings manufacturer based in Anji, Zhejiang province, boosted research and development investment and innovation capacity during the 14th Five-Year Plan period (2021-25).

In 2024, the company's R&D spending climbed to 226 million yuan ($31.65 million), the highest since it went public on the Shanghai Stock Exchange in 2017. By the end of the year, it held 1,630 valid patents, including 142 invention patents.

Revenue surpassed 10 billion yuan for the first time in 2024, reaching 11.03 billion yuan — a 34.6 percent increase from a year earlier, according to its earnings report.

To navigate a complex global trade environment, Heng Lin has expanded its international footprint by establishing production bases in Vietnam and Switzerland, aiming to mitigate risks and improve operational efficiency. By the end of 2024, overseas assets totaled 5.77 billion yuan, accounting for 53.18 percent of its total assets.

The company has also built a global supply chain network, including 11 warehousing and logistics centers worldwide. Its overseas warehouses span 400,000 square meters, enabling delivery within one to three days across the United States and strengthening competitiveness in cross-border e-commerce and bulk sales.

Heng Lin maintains long-term partnerships with leading global retailers such as Ikea, Nitori, Home Depot and Amazon. Its products are sold in more than 80 countries and regions.

China's stock exchanges have released draft guidelines for corporate sustainability disclosures, marking the latest move toward raising the quality of environmental information disclosures and enhancing the investment appeal of high-quality Chinese listed companies.

The Shanghai, Shenzhen and Beijing bourses, under the guidance of the China Securities Regulatory Commission, issued the second batch of sustainability reporting guidelines for public consultation on Friday.

Covering pollutant emissions, energy use and water resources, the guidelines provide detailed guidance and standardized methods to help firms better identify risks and opportunities, calculate data and disclose key information.

While reinforcing listed companies' awareness of environmental risks and opportunities, the guidelines do not impose mandatory disclosure requirements beyond the existing framework, experts close to the matter said.

Instead, the guidelines aim to reduce compliance costs and help investors incorporate ESG information into their decision-making, with more practical guides to follow as part of a "batch-by-batch" rollout and to form a comprehensive sustainability disclosure system, they said.

As of June 2025, 1,869 listed companies on the mainland had published sustainability reports, increasing the overall disclosure rate to 34.7 percent — up about 10 percentage points from two years earlier.

By the end of 2024, 32 percent of listed firms in Shanghai and Shenzhen had seen their MSCI ESG ratings upgraded, drawing more foreign investors to increase their holdings.

CNOOC Ltd announced on Thursday that production on its Wenchang 16-2 oilfield development project has commenced.

Located in the western Pearl River Mouth Basin, with an average water depth of approximately 150 meters, the project will mainly leverage the adjacent existing facilities of the Wenchang Oilfields, with the addition of a new jacket platform integrating functions such as oil and gas production, offshore drilling and completion operations, as well as accommodation for personnel.

A total of 15 development wells are being commissioned, according to CNOOC, which owns a 100 percent stake in the project.

The project is expected to reach a production plateau of approximately 11,200 barrels of light crude oil equivalent per day by 2027.

zhengxin@chinadaily.com.cn