Restore investor confidence to improve FDI inflows

Editor's Note: Global foreign direct investment fell by 11 percent to about $1.5 trillion in 2024, marking the second consecutive year of decline. Nevertheless, there were some bright spots of growth in certain areas such as the digital economy. What do the current global investment trends indicate? Compared with developed countries, what advantages do developing countries have in attracting foreign investment? Will the global FDI outlook improve this year? Li Nan, director of the Division on Investment and Enterprise, United Nations Trade and Development, spoke to Chinanews.com on these issues. Below are excerpts from the interview. The views don't necessarily represent those of China Daily.

Global FDI declined in 2024 mainly due to a 58 percent year-on-year fall in inflows to Europe. The decline reflected the severe impact of geopolitical tensions and financial market instability on investor confidence. In addition, international project finance, which plays a critical role in infrastructure investment, dropped by 11 percent in Europe, underscoring investors' broader caution and the generally tighter financial environment.

In contrast, inflows to developing countries remained relatively stable. In 2024, developing economies accounted for 57 percent of global FDI inflows. Their total FDI reached $867 billion, roughly unchanged from the previous year. This highlights the resilience of developing countries against a backdrop of continued global uncertainty, tighter financial conditions and weak trade. FDI inflows to developing economies were highly concentrated, reflecting the difficulties faced by smaller and more vulnerable economies in attracting international investment.

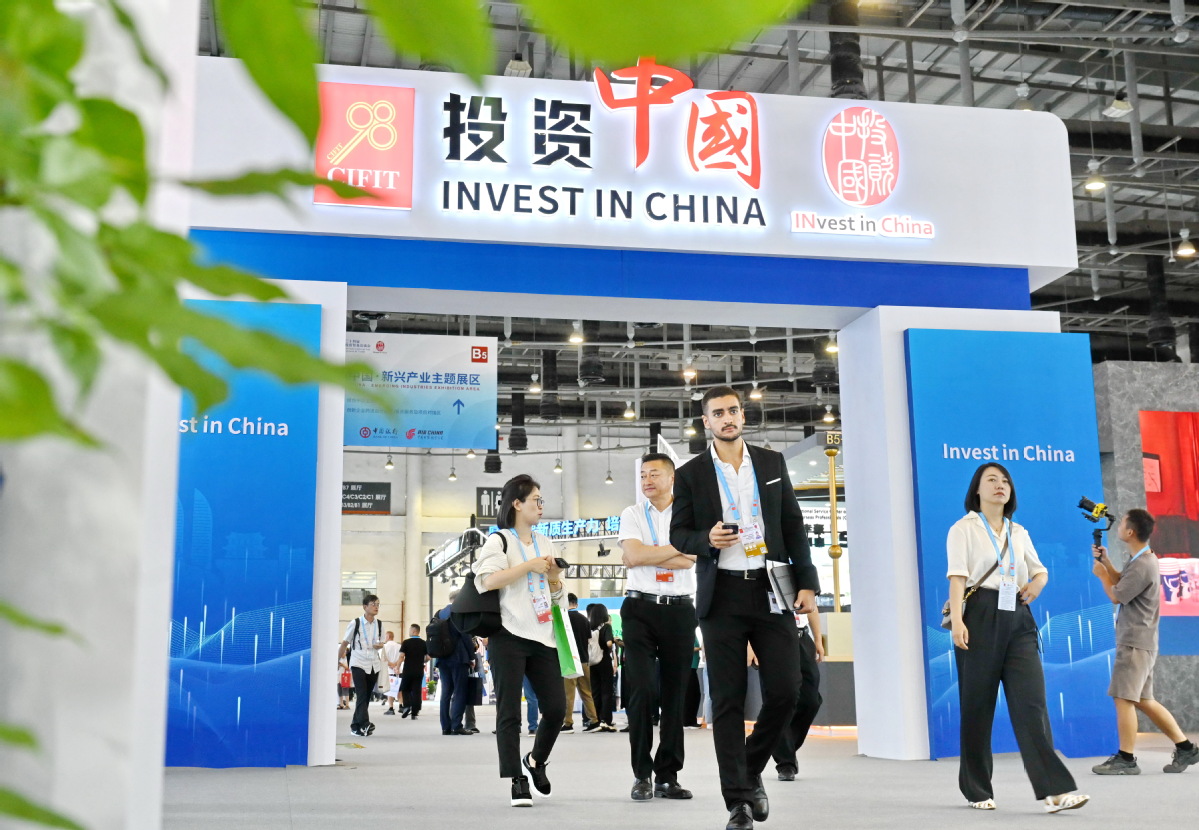

Developing and developed countries have a different attitude to FDI. In recent years, global investment policymaking has increasingly been shaped by geopolitical tensions and industrial policy objectives. Developing countries continue to emphasize openness to FDI, rolling out numerous supportive measures, while developed economies are increasingly inclined to adopt restrictive policies, particularly when it comes to national security and FDI screening.

More than 40 percent of the adverse measures introduced in 2024 involved new or expanded screening mechanisms. These were mainly adopted by developed economies, targeting high-tech industries as well as critical raw materials essential to the energy transition and supply chain resilience. Meanwhile, industrial policy incentives have become the mainstream policy tool for attracting global investment, accounting for 45 percent of the favorable measures.

The digital economy is the fastest growing sector for global investment. In 2024, greenfield investment projects in this field surged to $360 billion. Between 2020 and 2024, developing economies attracted $531 billion in digital economy greenfield investment. However, these investments were highly concentrated, with nearly 80 percent flowing to 10 countries. Just six countries — India, Malaysia, Indonesia, Singapore, Vietnam and China — accounted for more than 60 percent of the total FDI. In Latin America, Brazil and Mexico led the way, while in West Asia, Saudi Arabia and the United Arab Emirates were front-runners.

FDI in the digital economy helps promote the spread of technologies, improve productivity and foster inclusive development through technologies in areas such as health, education, finance and agriculture. It plays a key role in advancing the United Nations Sustainable Development Goals. However, its development differs across countries and regions, depending on factors such as infrastructure, digital capabilities, market conditions and regulatory frameworks.

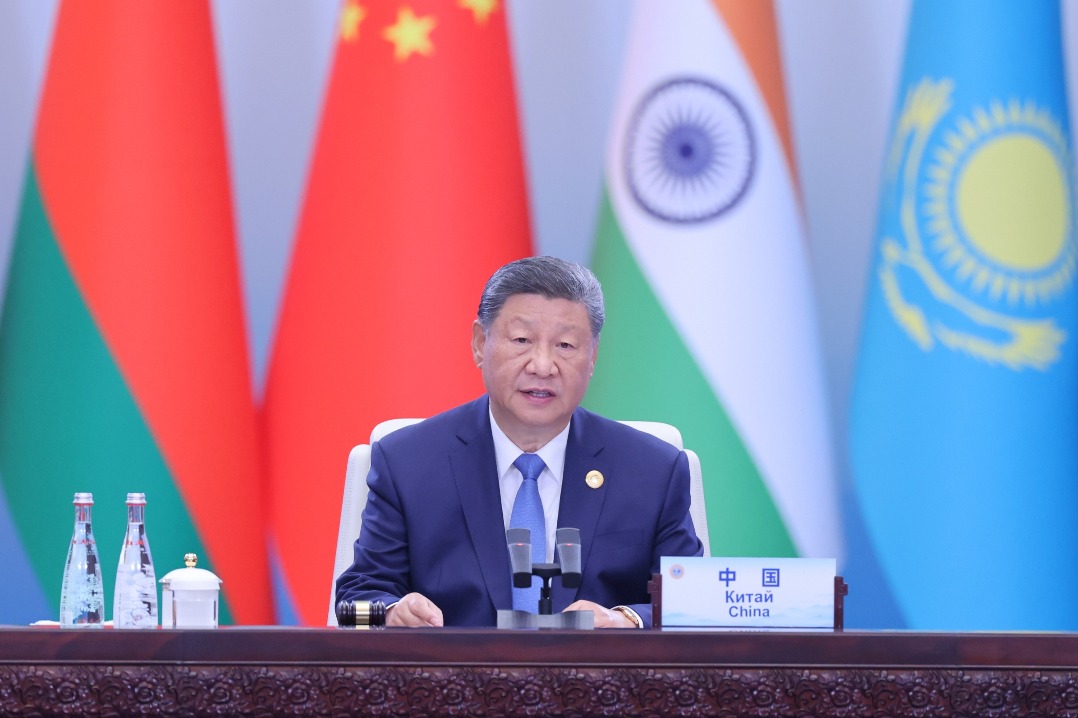

China and the United States are among the world's leading recipients of FDI. By working together, the two countries could help restore investor confidence worldwide and create a more favorable development environment for low-income and vulnerable economies. In recent years, China's FDI patterns have shown positive shifts, with inflows moving increasingly toward high-tech industries and advanced manufacturing. This reflects China's growing capacity to attract high-quality investment.